Social security online retirement estimator

Earnings above the tax cap arent taxed by Social Security or used to calculate retirement benefits. The Social Security Administration has an online calculator that will provide immediate and personalized benefit estimates to help you plan for retirement.

Service Disability Retirement Calpers

Those who delay claiming Social Security.

. For 2021 you may subtract all qualifying retirement and pension benefits received from public sources and may subtract private retirement and pension benefits up to 54404 if single or married filing separately or up to 108808 if married filing jointly. If you receive Social Security benefits the easiest way to change your address and phone number is by creating a personal my Social Security account. Social Security was never intended to be the sole source of income for retirement.

Has been a three-legged stool. In 2021 she received a lump-sum payment of 6000 of which 2000 was for 2020 and 4000 was for 2021. For joint filers the age of the oldest spouse determines the age category.

She appealed the decision and won. Recipients born before 1946. Jane also received 5000 in social security benefits in 2021 so her total benefits in 2021 were 11000.

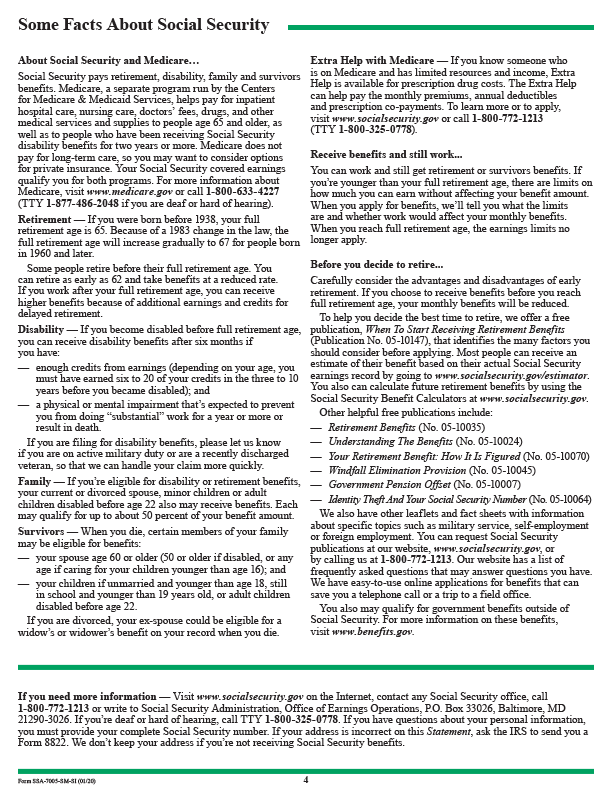

If you need to report a death or apply for benefits you can call Social Security at 800-772-1213 TTY 800-325-0778 between 8 am. Traditionally the retirement system in the US. The Retirement Estimator is an interactive tool that allows the user to compare different retirement options.

The Quick Calculator compliments of Social Security estimates your future checks but this one is about as simple as they comeEnter your birth date current years. Aquí nos gustaría mostrarte una descripción pero el sitio web que estás mirando no lo permite. Every year she delays retirement her Social Security payout which is adjusted annually for inflation rises by about 1649.

Based on the information you provide through the online tax questions via information from your Form 1099-SSA and other income sources W-2 from wages or salary 1099 from self-employment or contract or retirement income if you have them we will then determine whether or not you have to pay taxes on your Social Security income. Pick up where you left off. The maximum amount of earnings subject to Social Security tax is 147000 in 2022.

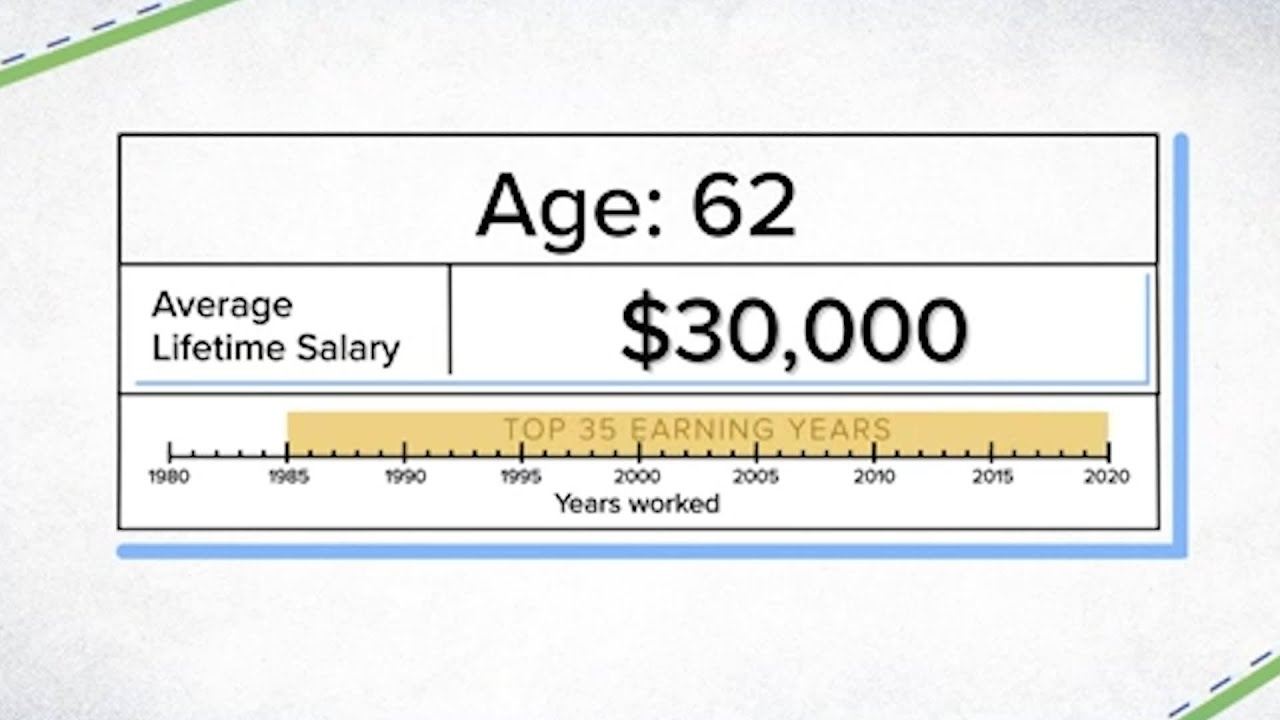

While the Social Security full retirement age has increased over the past several years the age when workers qualify for Medicare has remained age 65. With your my Social Security account you can plan for your future by getting your personalized retirement benefit estimates at age 62 Full Retirement Age FRA and age 70. If the only income you received during the tax year was your social security or equivalent railroad retirement benefits your benefits may not be taxable and you may not have to file a tax return.

You also cant report someones death to Social Security online. Return To A Saved Application Already started an application. Online Services Change Your Address and Phone Number Online with my Social Security.

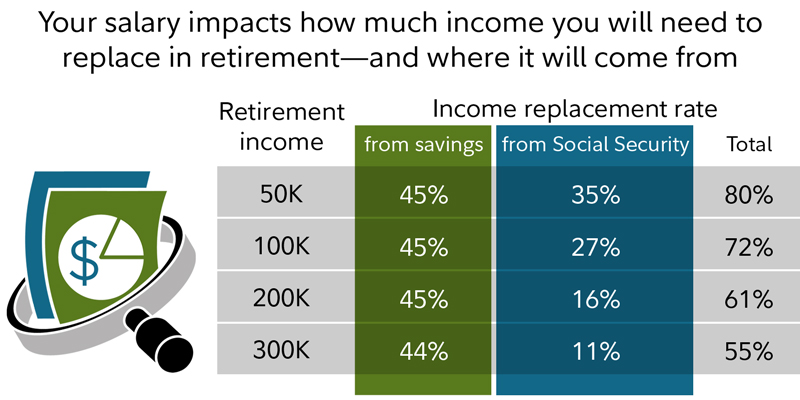

Your personal my Social Security account gives you secure access to information based on your earnings history and interactive tools tailored to you. Avoid mail delays and get your Form SSA-1099 or SSA-1042S Social Security Benefit Statement online at the Social Security Administration. Social Security savings and pensions.

Kitts and Nevis Social Security Fund is a compulsory insurance fund established by an Act of Parliament in 1977. If you give the funeral home the persons Social Security number theyll often make the report. In 2020 she applied for social security disability benefits but was told she was ineligible.

August 18 2022 By Stephen McGraw Director Division of Strategic Communications. You can also view retirement benefit estimates by. Apply For Retirement Benefits Our online retirement application lets you apply for retirement in as little as 15 minutes.

My Social Security Retirement Estimate Get personalized retirement benefit estimates based on your actual earnings history. It began operations on February 1 1978 taking over from the National Provident Fund which was basically a.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

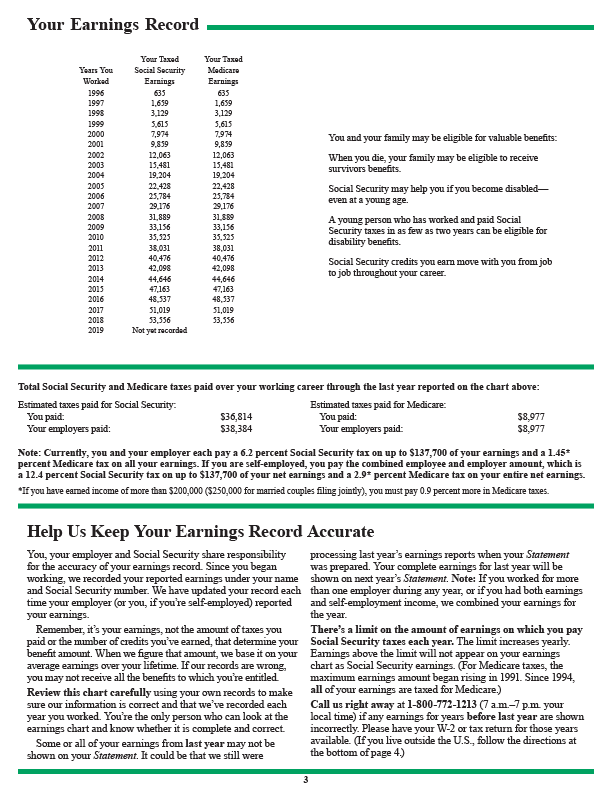

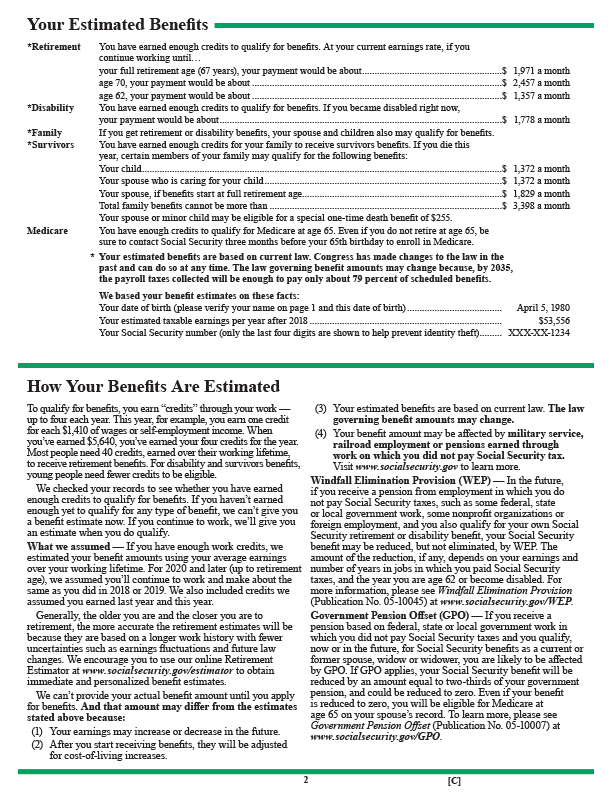

Analysis Of Benefit Estimates Shown In The Social Security Statement

Retirement Estimator Investor Gov

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

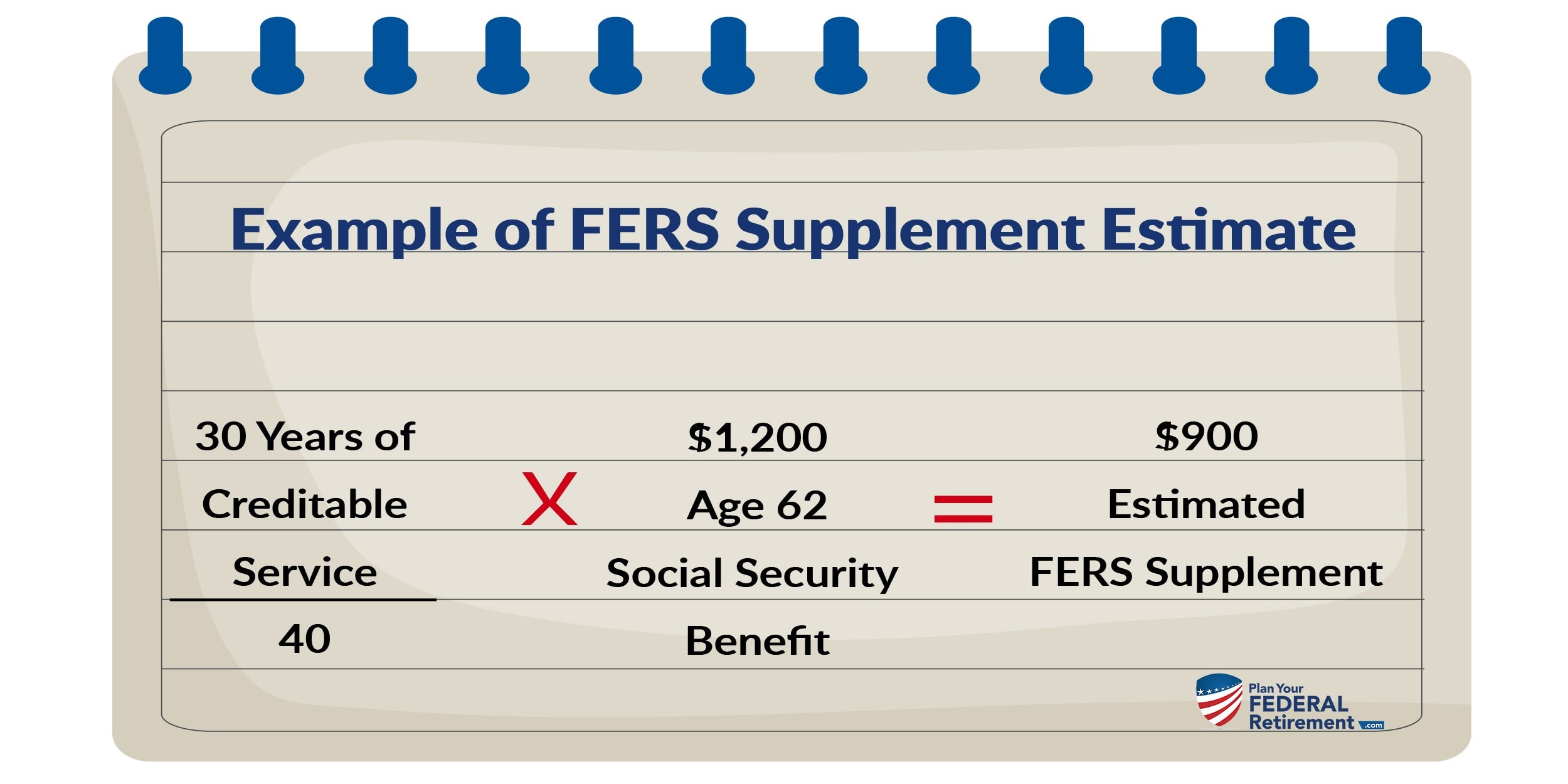

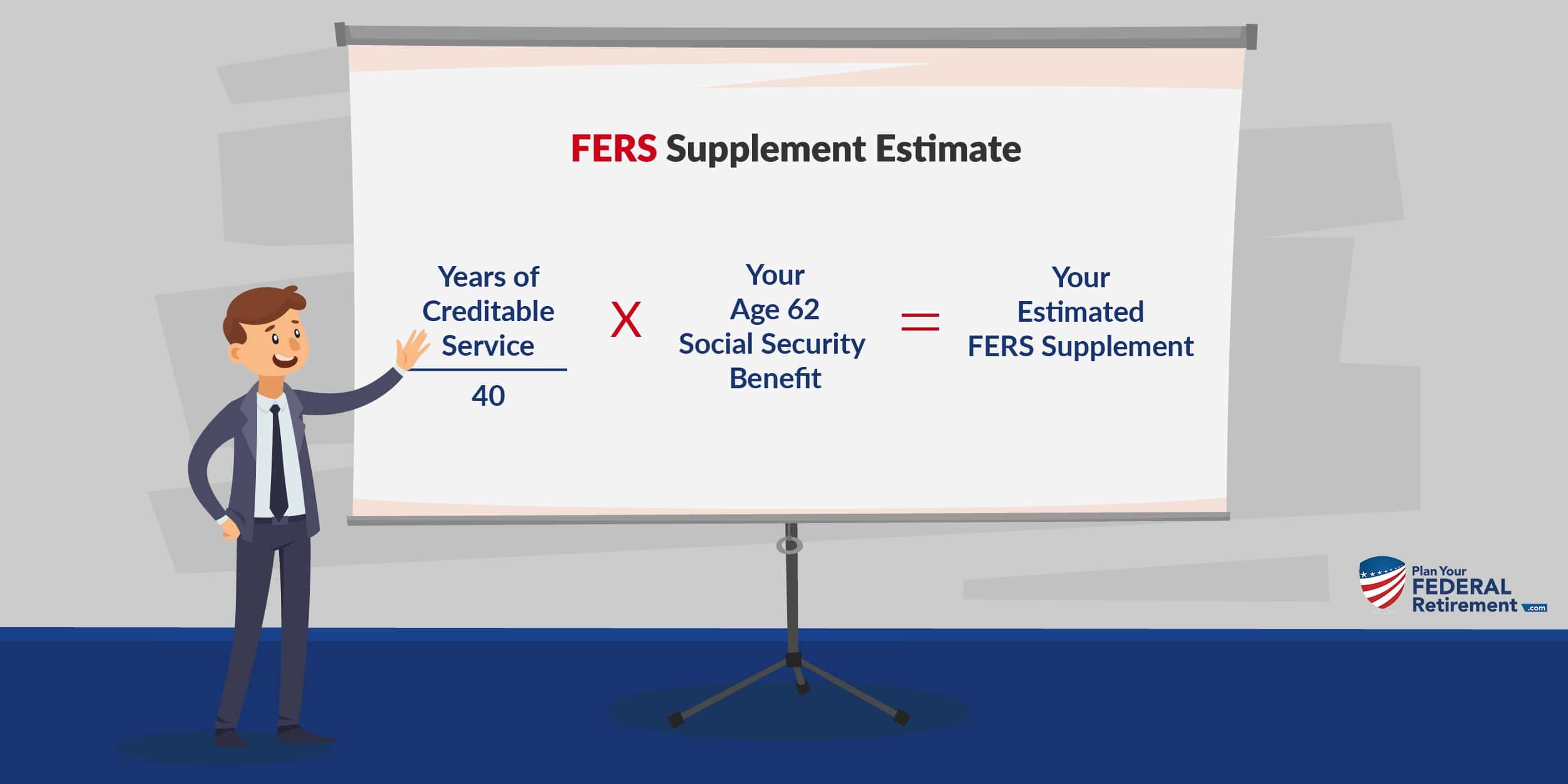

Fers Supplement Plan Your Federal Retirement

Analysis Of Benefit Estimates Shown In The Social Security Statement

Social Security Sers

Analysis Of Benefit Estimates Shown In The Social Security Statement

Fers Supplement Plan Your Federal Retirement

What Will My Savings Cover In Retirement Fidelity

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

How Much Your Social Security Benefits Will Be If You Make 30 000 35 000 Or 40 000 Youtube

Analysis Of Benefit Estimates Shown In The Social Security Statement

Estimate Your Benefits Arizona State Retirement System

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Spousal_Benefits_Calculated_for_Social_Security_May_2020-01-29ec05cc8e7241ec95054d75a3d998aa.jpg)

How To Maximize Social Security Spousal Benefits

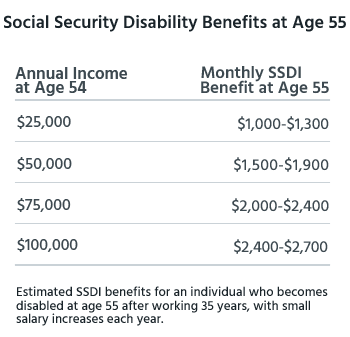

How Much Can You Get In Social Security Disability Benefits Disabilitysecrets

Information For Financial Planners Ssa