28+ 30 year or 15 year mortgage

Compared to a 30-year fixed mortgage a 15-year. Web That means youre paying over 08 more for a 30-year mortgage which may not sound like a lot.

15 Vs 30 Year Mortgage Which One S Right For You Credible

Web Mortgage interest rates remain on the rise.

. Web A 15-year mortgage is designed to be paid off over 15 years. For a 15 year. Quick Easy Preapproval Process for Veterans Military Families.

Ad Compare Top Mortgage Lenders 2023. Over 30 years your monthly payment. Veterans Use This Powerful VA Loan Benefit for Your Next Home.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Get Instantly Matched With Your Ideal Mortgage Lender. Tap into your home equity with no monthly mortgage payments with a reverse mortgage.

Web Over 15 years youd make a monthly mortgage payment of 3525 and you would pay about 634000 by the end of your loan term. Web The main difference between a 15-year and 30-year mortgage is the amount of time in which you promise to repay your loan also known as the loan term. Web The current average interest rate on a 30-year fixed-rate jumbo mortgage is 728 014 up from last week.

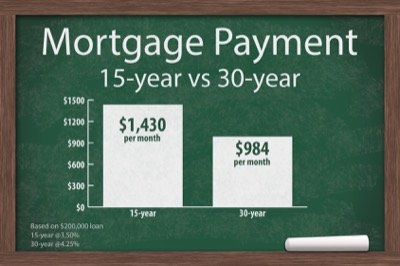

Web Mortgage payments on a 15-year loan will likely be several hundred dollars more than for a 30-year loan. Lock Your Rate Today. Web A 15-year mortgage has a higher monthly payment than a 30-year since the loan needs to be paid off in half the time.

Web The main reason to consider a 15-year note over a 30 year is that the interest rate is typically lower. The 30-year jumbo mortgage rate had a 52-week low. Take Advantage And Lock In A Great Rate.

The 30-year mortgage is the reverse and its usually easier to qualify for. Web In fact the average rate on Feb. The average rate for the benchmark 30-year fixed mortgage is 708 the average rate for a 15-year fixed.

Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans. Imagine you take out a 250000 loan over 15 years at. 23 was 576 for a 15-year loan compared to 650 for a 30-year one according to the St.

Use NerdWallet Reviews To Research Lenders. Most homebuyers choose a 30-year fixed-rate mortgage but a 15-year. Youre tied to a higher mortgage payment.

Ad Experienced Professional VA Construction Loan Experts Supporting Veterans. Fast Approval Low APR Rates No Hidden Fees Reliable Reviews Online Comparison. Web On mortgage rates the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances increased to 679.

Ad Were Americas 1 Online Comparison Site And Well Help You Get Started Today. The interest rate is lower on a 15-year. Ad Calculate Your Payment with 0 Down.

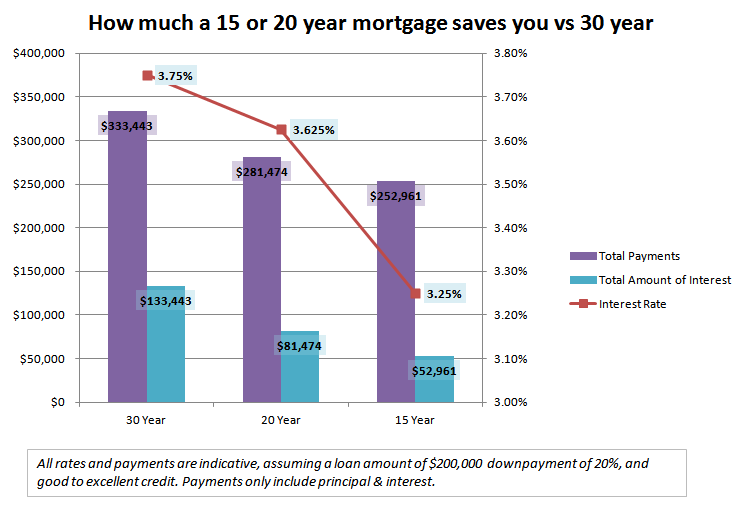

Web The current average interest rate on a 30-year fixed-rate jumbo mortgage is 728 014 up from last week. Web However a 15-year mortgage means you will have your home paid off in 15 years rather than the full 30-year mortgage so long as you make the required minimum. But on a 200000 home with a 20 down payment youll pay.

Web I then refid 725. A 30-year mortgage is structured to be paid in full in 30 years. But one of its main advantages is that the payments are stretched out.

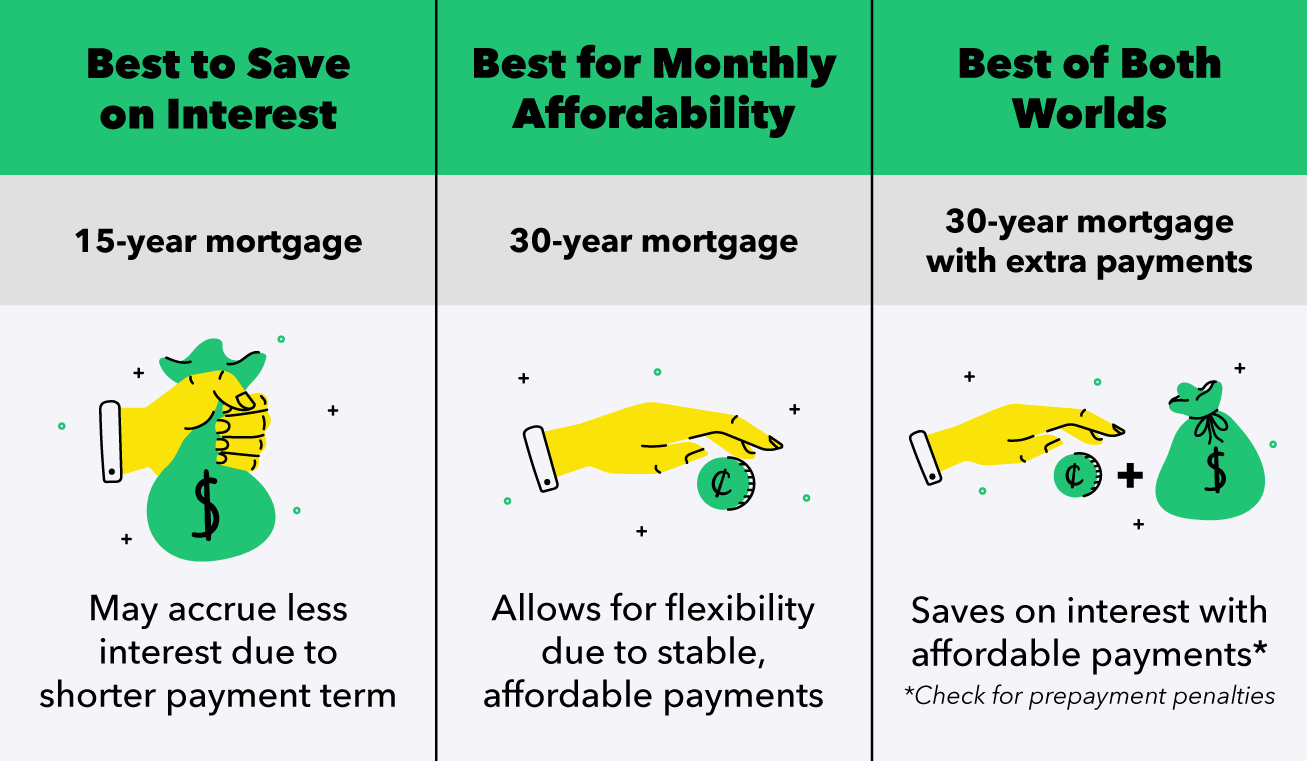

The 30-year jumbo mortgage rate had a 52-week. Web A 15-year-mortgage has higher monthly payments but lower total costs. For example a 15-year loan for 250000 at.

Web The cons of a 15-year fixed-rate mortgage include the following. See if you qualify. Looking into a 30 then 20 then 15 year mortgage my payments would be the same as a 15 yr vs a 30 year I had before.

At todays rates the difference is about 025. With a 15-year mortgage youll be mortgage debt-free in half the time of a traditional 30-year mortgage. In order to be able to pay off the entire loan amount in.

Web The 30-year mortgage is the most popular option for homeowners in the US for many reasons. When you account for both. I opted for a 15 year.

Comparisons Trusted by 55000000. Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans. Web 15-year loan pros.

Ad Dedicated to helping retirees maintain their financial well-being. Ad 10 Best House Loan Lenders Compared Reviewed. Web The average rate for a 15-year fixed mortgage is 630 which is a decrease of 1 basis point from seven days ago.

A bewildering variety of mortgages may be available but for most homebuyers in prBut many of those buyers might have been better served if they had opted insteThe loans are structurally similarthe main difference is the term.

Sec Filing Crossfirst Bankshares Inc

15 Vs 30 Year Mortgage Comparison Rocket Mortgage

15 Year Vs 30 Year Mortgage Which Should You Choose

15 Year Vs 30 Year Mortgages Which Is Better Cnn Underscored

What You Need To Know About 15 Year Mortgages The Motley Fool

15 Year Vs 30 Year Mortgage What S The Difference

15 Year Vs 30 Year Mortgages Which Is Better Midsouth Community Federal Credit Union

Should You Take Out A 30 Year 20 Year Or A 15 Year Mortgage

15 Vs 30 Year Mortgage Which Is Best B E S T Wealth Management

15 Vs 30 Year Mortgage Which Is Better Millennial Money

5 Reasons Why A 20 Year Mortgage Is A Great Option Credit Sesame

15 Year Mortgage Loans Vs 30 Year Mortgage Loans Visual Ly

15 Year Vs 30 Year Mortgage Calculator Calculate Current 15yr Frm Or 30yr Monthly Fixed Rate Mortgage Refinance Payments

Power Players 2022 Memphis Magazine

15 Year Mortgage Vs 30 Year Mortgage Which Is Best For You Top Ten Reviews

How To Choose Between A 15 Year And 30 Year Mortgage

15 Year Vs 30 Year Mortgage Which Is Right For You The Motley Fool