35+ can you pay off a reverse mortgage

Ad Compare the Best Reverse Mortgage Lenders. The loan doesnt have to be paid off while you live there.

Using Pv Function In Excel To Calculate Present Value

Ad A Reverse Mortgage Loan Could Provide More Financial Flexibility.

. One thing Social Securitys top earners have in common. Web The following options include how to pay off a reverse mortgage early or when it comes due. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly.

AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. They were high earners throughout most if not all of their working years. Web For somebody who is age 62 or older and has a good amount of equity in their home using a reverse mortgage to pay off the existing mortgage can be a tremendous benefit.

Compare a Reverse Mortgage with Traditional Home Equity Loans. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. For Homeowners Age 61.

Instead it is repaid all at. Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You. This is known as the right of.

Ad A Reverse Mortgage Loan Could Provide More Financial Flexibility. Web You then receive that extra 70000 as a lump sum payment. Web While a reverse mortgage can free up cash flow for seniors it also depletes the equity in your house.

You could use up your equity so you get nothing when you or your estate eventually. The proceeds from the sale of the house are used to. At the end of the term the loan is paid.

Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Web Reverse mortgages are usually nonrecourse debts and you will never owe more than the value of your home. If a borrower wishes to pay off a reverse mortgage they can start making payments on.

For Homeowners Age 61. Web Normally when you take out a mortgage loan the bank gives you a lump sum that you pay back with interest over time. Web Reverse mortgage requirements.

Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice. Web No one benefits from a foreclosure on a property with a reverse mortgage not the lender not the FHA who insures the loan and certainly not the borrower. Pay with savings While most reverse mortgage.

Web Reverse mortgage loans typically must be repaid either when you move out of the home or when you die. AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. To be eligible for a reverse mortgage the primary homeowner must be age 62 or older.

However the loan may need to be paid back sooner if the. But there are major risks you should know first. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You.

Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. Web Reverse mortgages have a 3-day period directly after you close on your loan in which you can cancel the transaction with no penalty. Youll have to repay the full 170000 that youve borrowed in regular monthly payments with interest.

Web A reverse mortgage is different from other loan products because repayment is not accomplished through a monthly mortgage payment over time. Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You. Web A reverse mortgage can help you pay for living expenses if youre retired and on a fixed income.

Web Generally a reverse mortgage must be paid back when you die or move from the home. Web With a reverse mortgage loan borrowers are not required to make monthly mortgage payments but can do so if they choose to. They do this by sending a letter that outlines the rules and.

Web Usually borrowers or their heirs pay off the loan by selling the house securing the reverse mortgage. Web Reverse mortgages can be paid off by the borrowers or the borrowers heirs. Its a situation that is.

Web When a reverse mortgage homeowner dies the lender must formally notify the heirs that the loan is due. Get A Free Information Kit. Web The answer is yes paying off your loan is one way to avoid potential reverse mortgage nightmares if things are heading in the wrong direction.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Web You can deduct mortgage interest on the first 750000 of the loan or 375000 if youre married and filing separately if you took out the loan before Dec. Sell the home Once payment comes due either the.

Web 3 hours ago1. The loan is repaid when you sell or. The additional eligibility requirements.

5 Ways A Reverse Mortgage Can Improve Your Retirement Keil Financial

Reverse Mortgage Steps For Early Payoff Goodlife

Seven Days January 12 2011 By Seven Days Issuu

Bond Market A Tad Antsy About Inflation Not Just Vanishing One Year Yield Nears 5 Mortgage Rates Back At 6 5 Wolf Street

Reverse Mortgage Steps For Early Payoff Goodlife

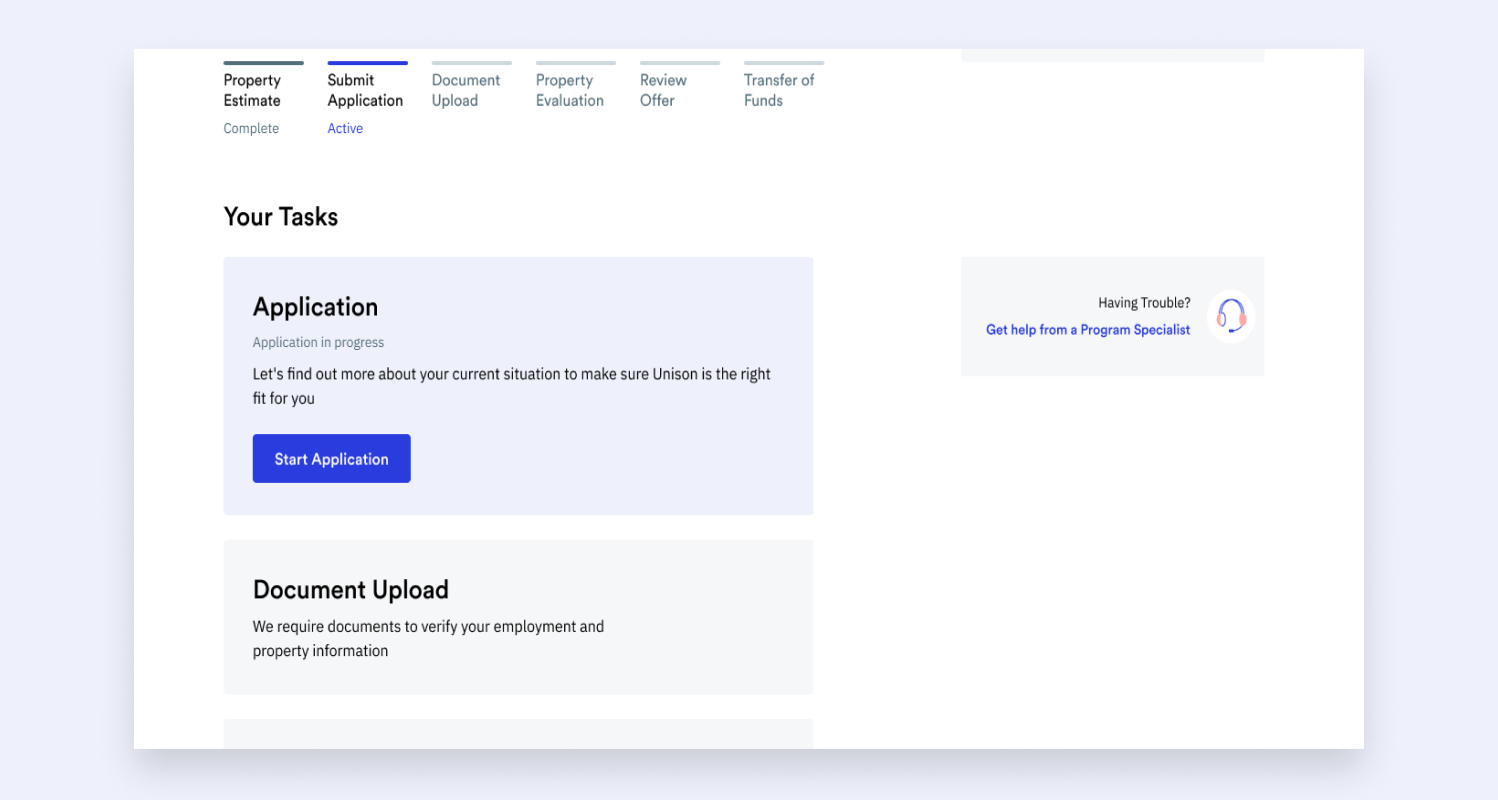

Reverse Mortgage Details Unison Home Equity Sharing Blog

Mortgage Broker Lori Lenaghan Opening Hours 106 3212 Jacklin Rd Victoria Bc

Reverse Mortgage Details Unison Home Equity Sharing Blog

Reversevision Taps Carissa Orozco As Director Of Business Development Strategic Partners Send2press Newswire

Is A Reverse Mortgage A Good Idea Hubpages

Rare Coins Worth Money Complete List With 35 Coins

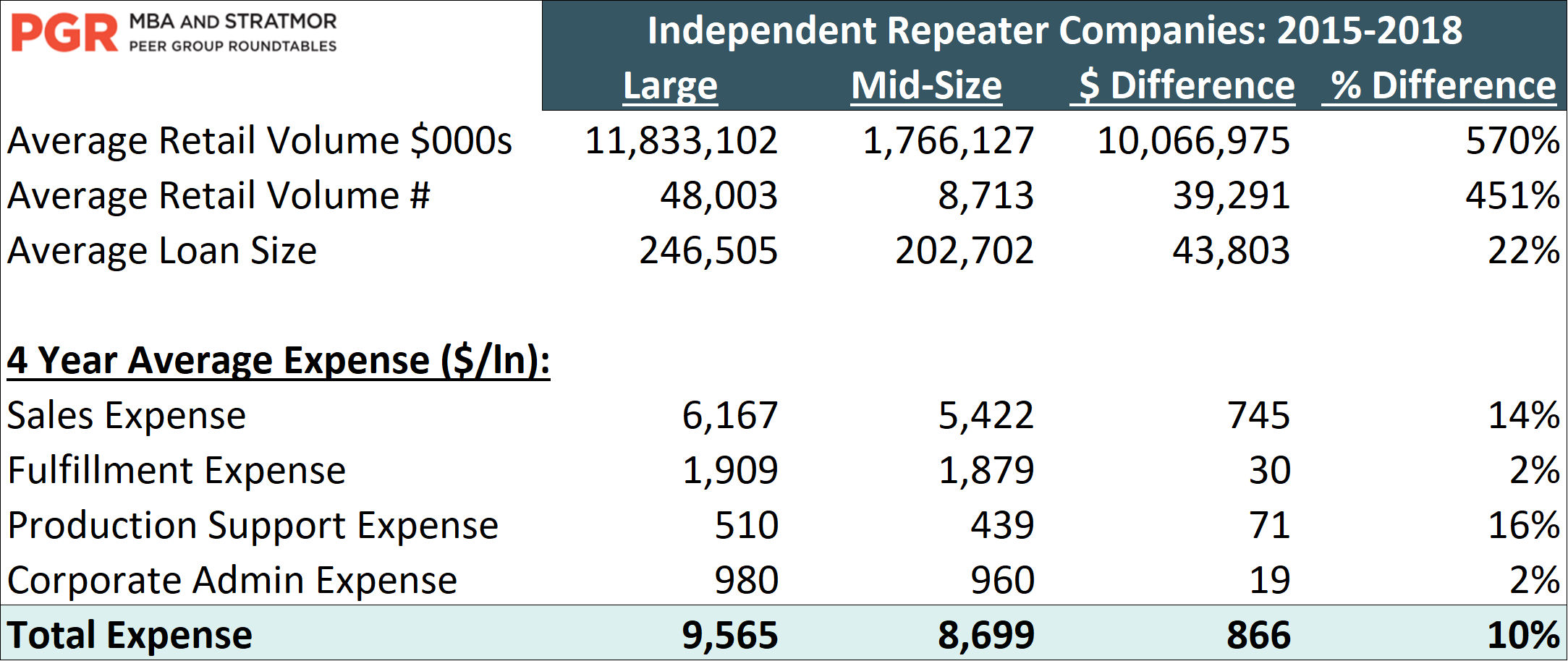

Myth Busters Dispelling Common Myths In Mortgage Banking Stratmor Group

P3gwoflk9s4m M

How To Pay Back Reverse Mortgage Bankrate

How To Invest In Shares A Step By Step For Beginners Moneyhub Nz

Mortgage Coach And Reversevision Team Up To Help Consumers Compare Forward And Reverse Mortgage Financing Options Send2press Newswire

Mortgage Navigators Sydney Home Loan And Mortgage Broker Specialists